Home equity lines of credit (HELOCs) offer homeowners a flexible way to borrow against their property’s value, with current national average rates hovering around 7.64% to 7.81% APR as of early December 2025. These variable rates have stabilized near two-year lows, making now an opportune time for qualified borrowers to explore options ahead of 2026 projections. As interest rates trend downward, HELOCs could provide cost-effective financing for renovations, debt consolidation, or investments, potentially dipping to 6-7% by late 2026.

Understanding HELOCs and Current Rates

A HELOC functions like a revolving credit line secured by your home, allowing draws during a typical 10-year period followed by a 20-year repayment phase. Rates are variable, often tied to the prime rate, which has benefited from recent Federal Reserve cuts. As of December 3, 2025, the average HELOC rate stands at 7.81%, with ranges from 4.99% for top-tier borrowers to 11.50% for those with lower credit profiles. Borrowers with strong credit scores above 780 and loan-to-value ratios under 70% often secure the best terms, including introductory offers as low as 5.99% for six months.

This stability comes amid broader economic easing, where U.S. homeowners hold a record $36 trillion in equity, averaging $313,000 per household. For a $50,000 draw at 7.50%, monthly interest-only payments during the draw period could total about $313, though full repayment over 30 years would require careful planning. Experts recommend comparing lenders, as factors like autopay discounts or relationship status can shave 0.25% to 0.50% off rates.

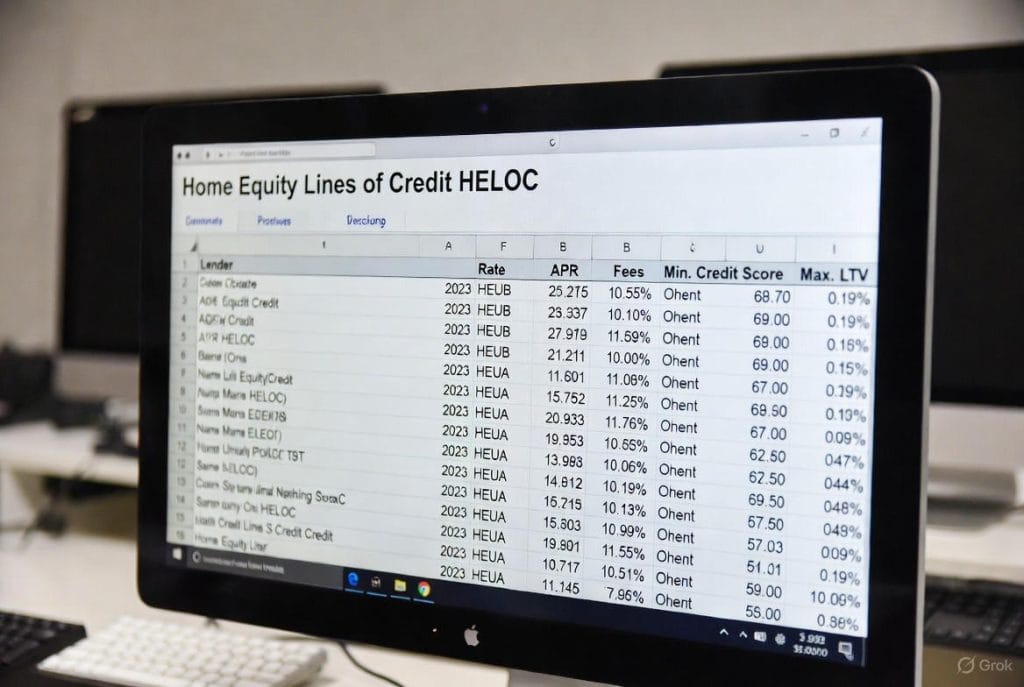

Top HELOC Lenders and Rates for 2026

Several lenders stand out for competitive 2026 offerings, prioritizing low fees, high limits, and borrower-friendly terms. U.S. Bank provides variable rates from 7.45% to 11.10% APR, with lines up to $1 million and no closing costs for many applicants. BECU offers introductory rates starting at 5.99% for six months, transitioning to 7.24% to 10.09%, ideal for credit union members seeking flexible draw periods up to 10 years.

Other strong contenders include Navy Federal Credit Union at 7.25% APR minimum and Bank of America with options around 8.50%, both emphasizing quick approvals and no annual fees. For larger loans, lenders like PNC and Connexus shine with no-appraisal policies and rates near 7.94%, suiting beginners in real estate investing. In 2026, anticipate origination volumes doubling to over $200 billion annually, driven by falling rates and high equity levels, so locking in early with these providers could yield savings.

HELOCs in the Broader 2026 Financial Landscape

HELOC rates align closely with mortgage trends, where 30-year fixed rates average 6.23% today and are forecast to ease to 6.3% in 2026. This creates synergy for homeowners considering refinancing, with cash-out options projected at 6.0% to 6.25% by mid-year, potentially saving $100 to $200 monthly on a $400,000 loan. Amid a mild recession outlook, high-yield savings accounts yielding 4-5% and CD rates topping 4.5% offer safe havens, but HELOCs provide lower borrowing costs than personal loans at 10-12% or credit cards averaging 20%.

For retirement planning, tapping home equity via HELOC could fund Roth IRA contributions or bridge gaps until age 62, especially with S&P 500 outlooks predicting 5-7% growth and Nasdaq forecasts around 8%. Crypto strategies remain volatile, but conservative investors might allocate 5-10% of a $100k portfolio to stablecoins yielding 5%, using HELOC proceeds for diversified real estate like beginner flips. Side hustles such as gig economy driving or online freelancing could pair with 0% APR credit cards for short-term needs, while business cards offer travel rewards up to 5x points.

Student loan rates around 5.5-7% and home insurance premiums rising 5-7% in 2026 underscore the need for holistic planning. Travel rewards cards with 3-5% cash back on flights can offset costs, and investment apps like Robinhood or Acorns simplify $100k deployments into index funds. Stock predictions favor steady gains if inflation cools to 2.5%, making HELOCs a strategic tool for leveraging equity without disrupting primary mortgages.

Strategies for Securing the Best HELOC in 2026

To maximize benefits, maintain a credit score above 740 and keep debt-to-income under 43% for optimal rates. Shop multiple lenders, as introductory periods and fixed-rate conversions can protect against volatility. In a forecasted low-rate environment, using HELOCs for value-adding home improvements could boost equity faster than inflation erodes savings.

Consider interest-only draws for flexibility during economic uncertainty, but avoid overborrowing given variable rate risks. Pairing with high cash-back cards at 2-5% or top rewards programs enhances overall finances. Ultimately, HELOCs shine for adaptable funding in 2026’s evolving market.